A lack of access to decent housing can perpetuate inequality that persists across generations. And in that sense, countries all across Latin America and the Caribbean are facing housing crises—but each experiences those challenges in unique ways. In rapidly urbanizing cities, for example, where land and construction costs are high, demand for affordable housing outstrips supply. In other places, it can be difficult or too expensive for homebuyers to obtain a mortgage.

Those related challenges, playing out in distinct contexts, demand unique, thoughtful policy solutions. And now, a new report that “harmonizes” disparate housing data from a dozen Latin American countries puts the region’s housing landscape in clearer perspective for policymakers.

The 2024 LAC Housing Yearbook, a collaboration between the Lincoln Institute of Land Policy and CAF—Development Bank of Latin America and the Caribbean, catalogs more than 250 housing and financial indicators across 12 countries (Argentina, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Mexico, Panama, Peru, and Uruguay) to allow comparisons across the region. The report is now available in Spanish, with English and Portuguese translations coming soon.

“By collecting and standardizing this broad set of information, the project aims to address knowledge gaps, enable cross-country comparisons, and support the formulation of efficient and targeted policies that reduce housing deficits, improve accessibility, and promote sustainable development,” says Pablo López, senior executive housing coordinator at CAF.

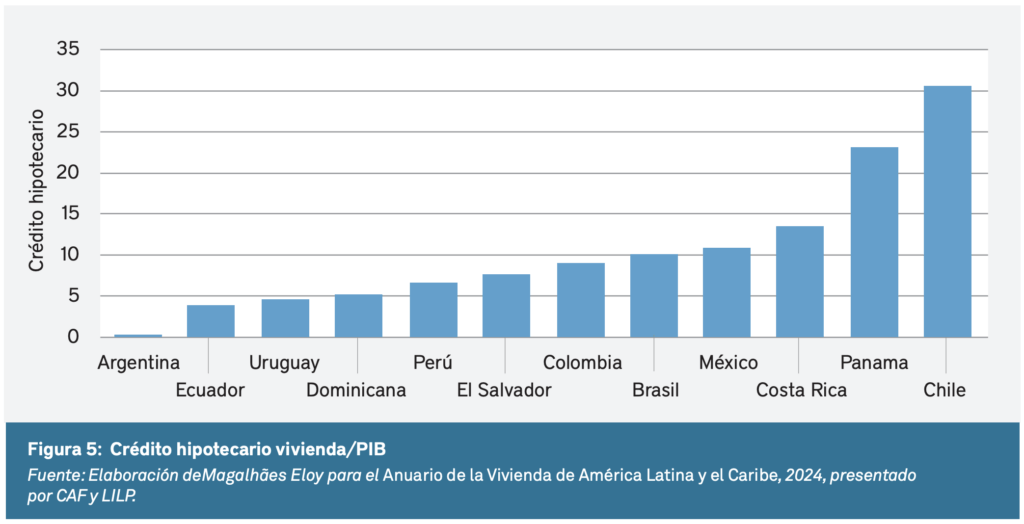

“The data reveal stark realities,” continues López, whose team presented the inaugural report to the General Assembly of the Ministers and High Authorities of Housing and Urban Development of Latin America and the Caribbean (MINURVI) in December. “Housing deficits are significant, mortgage penetration remains low, and affordability is continually eroded by costs rising at higher rates than incomes.”

The types of indicators tracked across the 12 countries include inflation and mortgage rates, formal and informal labor market participation rates, construction costs per square meter, and both quantitative and qualitative measures of a country’s housing deficit—the former referring to the number of additional homes needed to meet demand, the latter tabulating the number of families living in substandard housing. In addition to an almanac of statistical information, the report includes a regional overview and in-depth profiles of each country’s housing market.

“It’s quite an ambitious project, because of the wide range of data categories it attempts to consolidate,” says Luis Quintanilla, senior policy analyst at the Lincoln Institute. The hope is to update the yearbook annually, which will allow for year-over-year comparisons, and to expand the list of countries over time. “We think it’s a very valuable resource,” he adds. “We hope it will be helpful for housing ministers and urban development secretaries, as well as practitioners, developers, banking and financial institutions, and other researchers.”

Gathering some of the data presented a “formidable challenge,” López says, scattered as it was across various public and private databases, and required meticulous cross-referencing, if it was available at all. For example, information on microfinancing—small, non-mortgage loans that families can use to make incremental improvements to their homes—was inconsistent and fragmented. And reliable figures on informal housing production and credit access for informal workers were difficult or impossible to find.

The process also revealed some information gaps that researchers or public agencies could address in the future, as well as some inefficiencies in housing subsidies. “Counterintuitively, some countries’ housing support mechanisms lack social targeting, [so they’re] benefiting higher-income groups, undermining their intended social equity objectives,” López explains.

The countries studied aren’t just experiencing the housing crisis in different ways, they’re also taking different steps to address it. “While countries share fundamental housing challenges, their approaches vary significantly,” López says. “The research revealed pockets of innovation and progress across the region—each nation demonstrated unique strengths that offer insights into potential solutions.”

Chile, for example, has developed a sophisticated mortgage market “complemented by innovative rental subsidy programs that address housing affordability from multiple angles,” López says. Panama can boast relatively low mortgage rates and a credit market that reaches almost a quarter (23.1 percent) of GDP, “a notable achievement in a region often characterized by limited financial inclusion,” he adds. “Meanwhile, Ecuador and Peru are pushing boundaries through pioneering green financing instruments, including innovative green bonds and mortgages that signal a forward-thinking approach to sustainable housing development.”

Still, the data make clear that no country has comprehensively solved its housing challenges, López says. “Instead, the region demonstrates a mosaic of targeted innovations, each addressing specific dimensions of a complex housing landscape.”

Quintanilla hopes this new collection of reliable, comparable data will help policymakers reach out and learn from each other. “If some particular country finds a similar context, but different outcomes, we hope that highlighting some of those discrepancies may be the spark for an exchange of ideas and transferable lessons,” he says.

Jon Gorey is a staff writer at the Lincoln Institute of Land Policy.

Lead image credit: CAF—Development Bank of Latin America and the Caribbean.