Policy Brief

Policy makers frequently face political pressure to reduce property taxes, but many approaches undercut the success of adopted policies. This policy brief describes how U.S. states can provide effective property tax relief for homeowners without compromising municipal fiscal health or services. The authors present an overview of targeted measures including homestead credits, circuit breakers, and deferrals, offering an essential resource for state legislators, governors, students of public finance, and policy makers who help make decisions about property tax relief.

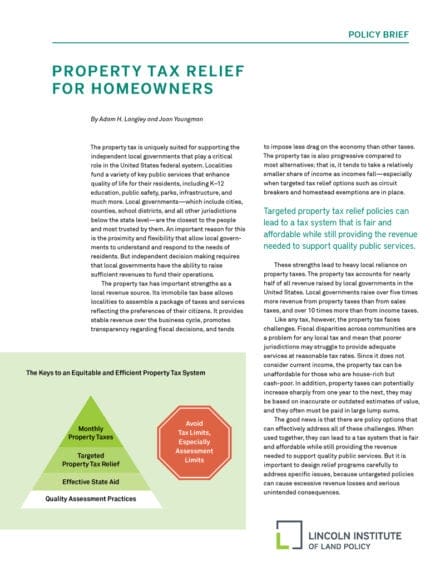

This Policy Brief is a condensed version of Property Tax Relief for Homeowners, a Policy Focus Report by Adam H. Langley and Joan Youngman that has been described as “a must-read guide for those thinking about possible reform and ways to ensure the property tax remains an equitable source of local support.”

Keywords

Housing, Property Taxation