Virtual Valuation

China is one of a small number of countries around the world that does not levy property tax on privately owned residential properties. After the Communist Party established a socialist regime in 1949, China adopted a public land ownership system and thereby lacked a real estate market until the reform era.

Since the reform, property sales, along with the economy as whole, have boomed. First-tier cities such as Shanghai and Beijing are now home to some of the world’s most expensive real estate. But taxes are imposed only at the point of property sales and transactions, not annually on ownership.

It may come as a surprise, then, that China is driving the evolution of valuation technology, particularly in Shenzhen—the brand-new southern city that has grown from a small town of 50,000 residents to a major metropolis of 12 million since 1982. The Shenzhen Assessment Center—a municipal statutory agency that was established to assist the collection of taxes on real estate sales and transactions—has developed what is arguably the most advanced property valuation system in the world. It is a logical extension of the computer-assisted mass appraisal (CAMA) system that the Lincoln Institute was instrumental in developing for desktop computers decades ago. The Peking University–Lincoln Institute Center for Urban Development and Land Policy (PLC) has helped several Chinese cities implement CAMA in anticipation of a future property tax. What makes Shenzhen’s system different is that it uses GIS technology and new techniques that elevate CAMA to the next level.

Today, CAMA is an international standard that has made it possible to assess entire metro areas from a desktop computer. But CAMA by nature is mainly a two-dimensional system, whereas modern geographical information system (GIS) software is capable of efficiently rendering three-dimensional (3-D) maps. The future of property assessment lies in marrying CAMA techniques with GIS tools in a system known, naturally, as “GAMA.”

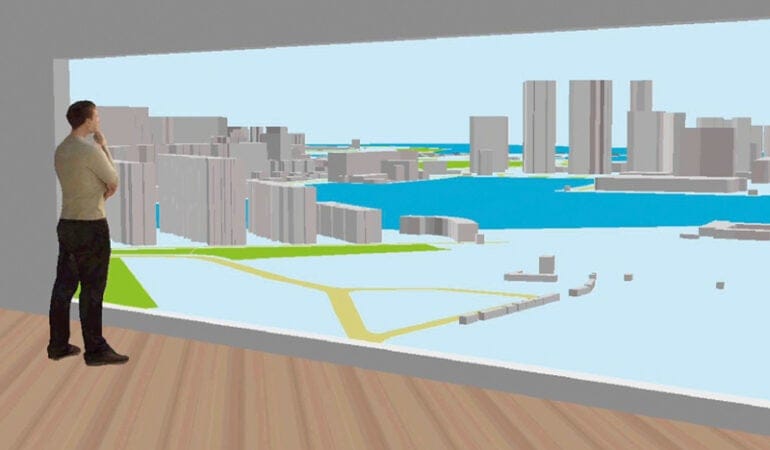

CAMA systems are, broadly speaking, not overly exciting to look at, with lots of data tables and highly detailed two-dimensional maps. GAMA by contrast is dazzling. Using GIS tools, the system constructs 3-D models of entire cities, with streets, buildings, the individual properties within them, landscape features, and so on. Imagine the feel of an open-world video game. The aim is to be able to appraise every property from computers in the assessment office.

“In my view, Shenzhen is dragging CAMA into the next generation, doing things in their valuation that nobody else can do,” says George W. McCarthy, president and CEO of the Lincoln Institute.

Shenzhen: Center of Progress

In many ways, the development of Shenzhen’s property assessment system is the classic story of modern China: starting from far behind, absorbing knowledge from more advanced economies, adapting to local needs, and ultimately coming to rival the best in the world. The fact that it happened in Shenzhen—the Special Economic Zone that launched the experimentation that transformed China from a largely rural economy to a global power—is unsurprising. In 1979, as China was charting the course of its new reform, four cities were declared “Special Economic Zones (SEZs),” pilot projects where the government would experiment with market mechanisms. Shenzhen, a fishing town of just 30,000 people, was one of them. Adjacent to Hong Kong, which was administered at that time by the British and highly internationalized, Shenzhen was in a perfect position to perform the mission of SEZs—attract global companies to trade, bring in foreign direct investment, and obtain for China the tools necessary to forge a modern developed nation.

As investment poured in and factories sprang up, Shenzhen became the beating heart of China’s new economy, and one of the world’s most advanced cities. In just 30-odd years, it grew into a bustling metropolis of nearly 12 million. Its official GDP in 2016 was US$284 billion (RMB 1.88 trillion), with a per capita GDP of US$25,790 (RMB 171,013), more than triple China’s average. Sometimes called China’s Silicon Valley, it is home to some of the world’s most powerful tech companies, including Internet giant Tencent.

As early as 2003, the central government started to consider introducing a property tax. Six cities were selected as pilot experiment cities for mass appraisal of properties. Shenzhen was one of them. Shenzhen’s Center for Assessment and Development of Real Estate was founded that same year to commence the enormous task of citywide valuation. At first, they were more or less on their own and progress was slow. It took three years to designate basic prices in 56 neighborhoods, in order to assign a single price for the whole area.

The initiative coincided with the Lincoln Institute’s foray into China in 2003, when it began developing relationships with government agencies and conducting research projects on topics ranging from property tax and municipal finance to public land management and land expropriation. “We saw the changes as the economy was being opened up, and we figured there would be all sorts of land policy challenges to grapple with,” McCarthy says.

In 2007, the Lincoln Institute and Peking University, China’s oldest and most prestigious university, endeavored to open the PLC, a research institute staffed by both organizations. One of the PLC’s early tasks was to help the Chinese government understand how to create a property tax that works as a system of revenue. The PLC organized training events to disseminate international knowledge of property taxation and computer-assisted mass appraisal to China. The PLC invited experts from the International Association of Assessing Officers, International Property Tax Institute (IPTI), Rating and Valuation Department of Hong Kong, ESRI Canada, and others. To better demonstrate how CAMA worked, the PLC launched a pilot demonstration project that established a CAMA system for the financial district of Beijing. The PLC also mobilized international experts to assist Shenzhen and Hangzhou, and funded study tours for technical personnel, in the United States, Canada, and Hong Kong. The impact was enormous.

“The PLC was translating the professional literature on property valuation, and it was the first time we were encountering some of this stuff,” says Dr. Wang Youjie, head of the Shenzhen center’s mass appraisal department. “They also introduced us to CAMA.”

Aided by access to a developed body of knowledge, progress in Shenzhen rapidly accelerated. By 2010, the center had evaluated prices on a per-building basis for 170,000 buildings, and by 2011 had done basic evaluations for 1.5 million residential properties. “After understanding the theory better, 2010 to 2011 was a breakthrough point for us,” says Xia Lei, director of the Shenzhen Assessment Center.

Also important was the Lincoln Institute’s role as a connector, enlisting top foreign experts to host seminars and perform hands-on training and development work. To date, the Lincoln Institute has mobilized more than 20 property tax experts to China. For the assessment center in Shenzhen, no one was more familiar than Michael Lomax.

For 22 years, Lomax worked as property assessor for British Columbia Assessment, a province-wide assessment office in Canada. He was among the first people the Lincoln Institute brought to China in 2007, when he joined a government delegation. He has continued making trips to China even after leaving British Columbia Assessment in 2012 to take a position with ESRI, which specializes in GIS solutions.

“A lot of my work in China was to illustrate, convey, and help them install worldwide best practices,” says Lomax, who also teaches mass appraisal at the University of British Columbia. Around 2011, he began working more directly with the Shenzhen center and an appraisal firm hired by the city of Hangzhou, Zhejiang, a city not far from Shanghai. Like Shenzhen, Hangzhou is also known for its tech industry, including the headquarters of e-commerce titan Alibaba.

The speed at which these two cities were working was sometimes astonishing. During one trip to Hangzhou, Lomax spent an entire day critiquing the assessment system built by the local department. The next morning, they asked him to look again. “They had their programmers stay up all night at the hotel to fix all the problems I pointed out,” says Lomax, still a bit in awe. “This might take you six months to do in the West, and they did it in hours.”

The team in Shenzhen was equally impressive. According to Lomax, they took the computerized evaluation methods to the next level. “They are really advanced in fine-tuning the mathematics,” he says. “Shenzhen is far better at valuing properties dynamically, on the fly, than British Columbia.”

In other words, there was a clear opportunity in Shenzhen to advance the GAMA evolution. “It was Michael that gave us the idea of doing GAMA,” says Wang.

From Follower to Leader

ESRI, a global consulting firm specializing in GIS solutions, is helping to build GAMA models in several municipalities. There is Vancouver, where Lomax works; Maricopa County, Arizona, which encompasses Phoenix; and also Shenzhen. These projects are in varying stages of development, but the Shenzhen system is impressive nonetheless. Sitting in on a demonstration of the system is like inhabiting a painting inside a painting, as if you might spot your virtual self if you peeked in the right window. But what it can do in terms of assessment is even more impressive.

Of course, it factors in all the indicators accounted for by a traditional CAMA system: location, number of rooms, floor space, recent market prices, and so on. It can also estimate the value of being near a subway station or close to a school. The three-dimensional nature of the system boosts the functionality. Using vectors, it is possible to model the window vantage point of every single unit in a given building. From the desktop, the appraiser can determine if a resident has a sweeping view of beautiful Lianhuashan Park in central Shenzhen (think New York’s Central Park, except with palm and banyan trees), or just the boring façade of a neighboring high-rise. The system can also track a virtual sun across the sky, estimating how much daylight an apartment gets. In addition to modeling light, it can also model sound—a lower-floor unit facing a busy traffic intersection, for instance, is disadvantaged compared to a unit facing a peaceful courtyard.

The system weights all those factors and synthesizes the final valuation of a property. All told, these factors can amount to a 20 percent difference in value between two units in the same building.

The system is also being used to better execute property transaction taxes. Through this smaller trial, the efficacy of the tool is apparent: of the millions of properties valued so far, only 27,106 challenges have been made as of January this year, and of those only 282 assessments had to be readjusted.

The Shenzhen assessment project is not without challenges. First, the market is young, so there is a relative dearth of transaction data. On top of that, transactions are sometimes reported at artificially low prices, to avert transaction taxes. Finally, the housing market is highly heterogeneous, with fairly distinct groups of housing types.

Limited property transaction data can be among the biggest challenges to implementing a system such as this. In this regard, Shenzhen has a distinct advantage over just about any other city in the world in terms of the knowledge of its properties. The whole place is brand new, and this is especially true for the city center where the slick 3-D model is most impressive. That means the data on all the buildings and floor plans is existing, complete, and rendered in digital formats that are, relatively speaking, easy to adapt to the model.

The team in Shenzhen cleverly innovated around this with a system they call the “holistic” approach. Briefly, it treats those distinct groups of housing first as separate “sub-markets.” Then by establishing relationships among those sub-markets, they are better able to estimate prices across the entire market with fewer data points overall.

The system alone is marvelous from a technical standpoint, but it is also a testament to the advanced nature of the city as whole. In numerous ways, it is an “only in Shenzhen” achievement.

Shenzhen is unique in a purely Chinese context as well. Conjured by the pure political willpower that gave life to the Special Economic Zones, Shenzhen is not directly administered by the central government. However, as a prefecture-level municipality, Shenzhen enjoys closer relationship with the central government than other prefecture-level municipalities. The central government grants more freedom to Shenzhen to try new things.

“In Shenzhen, government agencies, such as the municipal commissions of planning and land, and finance and taxation, are cooperating to share data,” says Director Xia. In a country where interdepartmental data sharing is rare, it is difficult to understate how important this is. “The point is to be creative.”

Geng Jijin, who directed the assessment center before Xia, when development of the model was most intense, puts a more personal spin on it: “Everybody here is from different places in China. We have no choice but to figure out how to get along.”

The Road Ahead

The job of creating the GAMA system in Shenzhen is not yet finished. Partly because Shenzhen grew at such a breakneck pace, a significant portion of buildings from the newly annexed localities are rather poorly documented. According to Director Xia, bringing these properties into the system is a top priority going forward. Given the scale of Shenzhen, it will likely take a few years to work through the challenge.

The implementation of a property tax goes beyond the purview of the Shenzhen Assessment Center. It is a policy problem and the center does not make policy, Wang says, adding “If the policy is put forward, Shenzhen is ready for it.”

It is anyone’s guess when that might happen, given the politically sensitive nature of property tax in China. While there have been two pilot taxes in Shanghai and the southwestern city of Chongqing, they have been very limited and undertaken mainly as a signal that property taxes are coming. Pressure is, however, building. In the absence of a property tax, and as the net revenues from land lease sales that local governments rely on have declined, local budgets have become increasingly strained.

In the meantime, the assessment center is already helping to spread knowledge beyond its very special borders. Delegations have been sent from all around China to view the system, including from across the river in Hong Kong and all the way from Taiwan.

Lincoln Institute President McCarthy, for his part, is ready to see knowledge and experience flow west. Places such as Boston, where there has long been controversy over building near Boston Common due to the shadows it would cause, could use a system that models the sun.

Actually spreading the new GAMA system will likely be difficult, and there is no telling how long it might take. But nobody would have predicted that a fishing village could become a metropolis in three decades flat.

Tom Nunlist is editorial director at Sinomedia and managing editor of CKGSB Knowledge, on behalf of Cheung Kong Graduate School of Business in Beijing.

The author extends special thanks to Carolyn Wang, a mass appraiser at the Shenzhen Assessment Center, who helped arrange reporting in Shenzhen. This piece would not have been possible without her expert help and remarkable patience.

Image Credit: Shenzhen Assessment Center

References

Chen, Xiangming, and Tomas de’Medici. 2009. “The ‘Instant City’ Coming of Age: China’s Shenzhen Special Economic Zone in Thirty Years.” Inaugural Working Paper Series, No. 2, Spring 2009. Hartford, CT: Center for Urban and Global Studies at Trinity College.

The Economist. 2012. “Time for a Property Tax: A Way to Stabilise Both China’s Wild Property Market and Its Weak Local Finances.” February 4. www.economist.com/node/21546014.

Shenzhen Municipal E-Government Resources Center. 2017. “Shenzhen Government Online.” http://english.sz.gov.cn/.

Wang, Da Wei David. 2016. Urban Villages in the New China: Case of Shenzhen. New York, NY: Palgrave Macmillan.

Xiao, Cai, Wang Yu, and Hu Yuanyuan. 2017. “Overall Govt Debt Risks ‘Under Control.’” China Daily USA, July 13. http://usa.chinadaily.com.cn/epaper/2017-07/13/content_30102302.htm.