Our Work

Duty to Serve

Duty to Serve is a federal regulation that requires Fannie Mae and Freddie Mac (the Enterprises) to serve three historically neglected markets: manufactured housing, affordable housing preservation, and rural housing. Every three years, Fannie Mae and Freddie Mac must develop a three-year plan with targeted objectives relating to outreach, loan product offerings, loan purchases, and investments. The UMMC harnesses the expertise and influence of housing finance stakeholders to help make Duty to Serve an effective regulation.

Equitable Housing Finance

In 2021, the Federal Housing Finance Agency required Fannie Mae and Freddie Mac to develop Equitable Housing Finance (EHF) plans to reduce racial or ethnic disparities in home ownership and spur investment in formerly redlined areas. The Enterprises’ first EHF plans for 2022–2024 were released in June 2022.

Currently, FHFA has yet to issue a regulation for EHF and only limited guidance for the Enterprises, without detailed criteria to structure their initial plans. In April 2023, FHFA issued a notice of proposed rulemaking for the EHF plans. The UMMC is evaluating the performance of Fannie Mae and Freddie Mac’s EHF plans and continues to encourage FHFA to adopt an EHF rule analogous to Duty to Serve.

UMMC Impact

The UMMC focuses on three actions: tracking the Enterprises’ DTS and EHF efforts, advocating for meaningful plans and policies, and working constructively with the Enterprises and FHFA to service underserved markets.

Tracking Enterprise Efforts

The UMMC has developed a tracking tool to closely monitor the performance of Fannie Mae and Freddie Mac under Duty to Serve. The tool measures the baseline performance for each objective, the proposed goals for 2022–2024, and the Enterprises’ progress toward their goals. It also incorporates UMMC members’ recommendations for further improvement. A tracking tool for Equitable Housing Finance is in development.

Advocating for Meaningful Plans

UMMC members collaborate to address the weaknesses of the Enterprises’ progress and advocate for meaningful improvements. The UMMC advocates by contributing to public listening sessions, writing comment letters, engaging with the media, and hosting webinars and events to express its recommendations.

In February 2024, the UMMC published a blueprint to urge the Enterprises to increase certain loan purchases in all markets, develop new, accessible loan products and programs, and evaluate new partnership opportunities. By creating a collective list of the most important action steps, the coalition hopes to expand and enhance the enterprises’ performance in underserved markets. The coalition will track the plans’ progress and publish a scorecard evaluating the GSEs’ success in adhering to the blueprint and implementing their plans.

Working with the Enterprises and FHFA

The UMMC works constructively with the Enterprises and FHFA. The coalition’s members meet regularly with officials to discuss its recommendations. These conversations help the UMMC understand the barriers that the Enterprises face in implementing DTS and EHF.

Government-Sponsored Enterprises’ (GSEs) Performance

Home ownership has long been part of the American dream, providing families a way to build long-term sustainable wealth. But a history of redlining and racial barriers to accessing capital has meant that this dream is still unattainable for many Americans. Today, the racial wealth gap between Black Americans and white Americans is the largest since the 1960s, and Black home ownership rates lag behind white rates by nearly 30%. UMMC coordinates 31 major affordable housing organizations for more equitable access to home financing. We collaborate to ensure that Fannie Mae and Freddie Mac meet their mission objectives of bringing housing finance opportunities to American families not traditionally served by the private market.

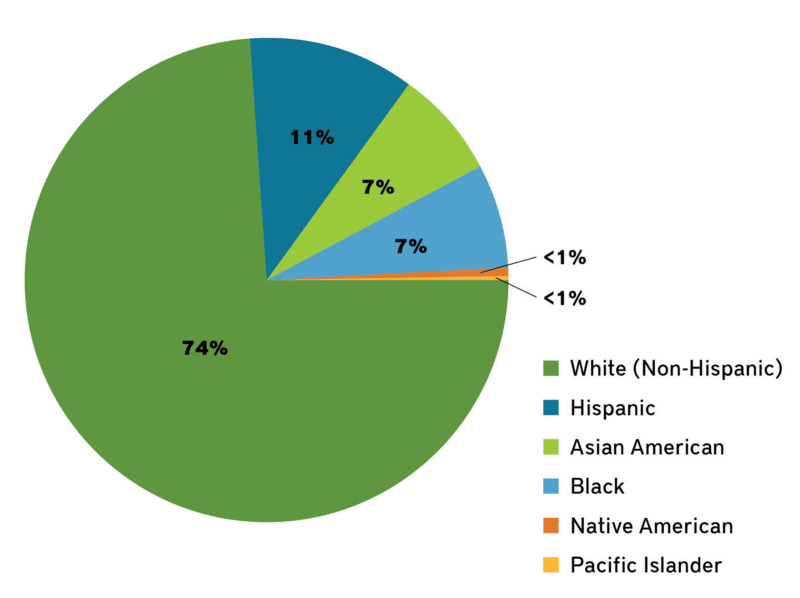

Freddie Mac and Fannie Mae Loan Purchases by Race/Ethnicity 2017–2022

- 4.47% of loans purchased by GSEs between 2017 and 2022 were for Black households

- Pie chart excludes loans with unreported race data, about 22% of GSE loans