The world’s cities need trillions of dollars to mitigate their greenhouse-gas emissions and safeguard their populations through adaptation and resiliency measures, yet only half of that need is being met through existing climate finance flows, which primarily rely on transnational public and private funding. Land-based financing is an underutilized approach that can, in combination with other revenue streams, help close that gap and accelerate transformational action.

In many countries, more than 90 percent of the total capital stock is embedded in land, buildings, and infrastructure. Yet for many municipalities, those assets remain an untapped financial resource. Land-based financing leverages this asset to generate revenue streams that can be used for climate adaptation, mitigation, and resilience.

What is land-based finance?

Land-based finance is an approach that enables local governments to generate revenues for or recover costs of infrastructure investments by recovering increases in land values that are the result of public investment and administrative or regulatory actions.

Using municipal finance instruments such as betterment levies, impact fees, sales of development rights, and the property tax, cities around the world have successfully embraced this approach to help pay for road improvements, bridges, affordable housing, and other urban infrastructure projects.

Because revenue from land-based finance is collected within and by a jurisdiction, it provides a level of autonomy over the management of finances and resources at the local level that is seldom available with national or international funds. When used in conjunction with sound urban planning principles, land-based financing can be an integral tool to help governments advance positive fiscal, social, and environmental outcomes, and can meaningfully contribute to climate action and a just transition to net zero.

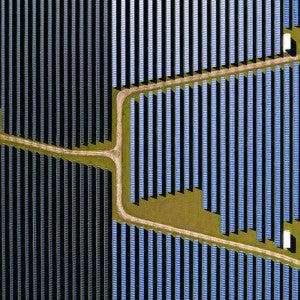

Land-based financing provides a funding source for local infrastructure projects that are key to climate mitigation and adaptation, such as public transit, green infrastructure, or flood resilience. This infrastructure addresses and reduces climate risks – like urban heat islands, poor air quality, and flooding – and brings additional livability benefits that may increase land and housing prices, creating a virtuous cycle of investment.

How can governments leverage land to finance climate action?

What are the key principles underpinning LVC? What are the potential impacts of climate adaptation and mitigation measures on property values? What are some examples of the application of land value capture instruments across the world?

Where is land-based financing being used to fund climate action?

Boston

In Boston’s rapidly developing Seaport district, the city is funding climate adaptation improvements, such as sea walls and green infrastructure, through developer contributions to a Climate Resiliency Fund. The city aims to use $40 million in developer contributions to fund critical improvements necessary to safeguard the Seaport from rising seas.

London

The city of London is leveraging two land value capture instruments, including the Community Infrastructure Levy, to generate nearly $800 million to partly finance the Crossrail railway extension. The project is expected to achieve approximately 2.75 million tons of carbon savings over its lifetime.

Atlanta

Atlanta established a special service district around parts of its new BeltLine—a 22-mile linear park around the city—where commercial and multi-family property owners will contribute slightly more in property taxes. The BeltLine will reduce reliance on automobiles, therefore reducing emissions, while also improving air quality and reducing flood risks with green infrastructure.

Curitiba

In Curitiba, Brazil, an innovative transfer of development rights (TDR) program has made it possible to implement a large-scale park system to absorb and contain floodwaters, while also relocating informal settlements located in high-risk flood zones. Through the TDR program, property owners in high-risk or environmentally sensitive areas obtain the right to build in designated areas of the city while their properties are converted into parks and green infrastructure.

What is the potential of land-based finance for transformative climate action?

Hear from a group of experts on the need for innovative, locally driven urban planning and climate finance instruments to catalyze urban climate action at scale.

Partners

The Cities Climate Finance Leadership Alliance is a multi-level and multi-stakeholder coalition aimed at closing the investment gap for urban subnational climate projects and infrastructure.

TAP is a global initiative to help local and regional governments transform their net-zero emission and resilient development infrastructure concepts into mature, robust and bankable projects ready for financing and implementation.