The Underserved Mortgage Markets Coalition (UMMC) consists of 32 leading US affordable housing organizations seeking to hold Fannie Mae and Freddie Mac (the Enterprises) accountable to their founding purpose: to bring housing finance opportunities to American families not traditionally served by the private market.

Reaching Underserved Mortgage Markets

Duty to Serve

Duty to Serve is a federal regulation that requires the Enterprises to serve three historically neglected markets: manufactured housing, affordable housing preservation, and rural housing.

Every three years, Fannie Mae and Freddie Mac must develop a three-year plan with targeted objectives relating to outreach, loan product offerings, loan purchases, and investments.

The UMMC harnesses the expertise and influence of housing finance stakeholders to help make Duty to Serve an effective regulation.

Equitable Housing Finance

In 2021, the Federal Housing Finance Agency required Fannie Mae and Freddie Mac to develop Equitable Housing Finance (EHF) Plans to reduce racial or ethnic disparities in home ownership and spur investment in formerly redlined areas. The Enterprises’ first EHF plans for 2022–2024 were released in June 2022.

The FHFA issued no regulation for EHF and only limited guidance for the Enterprises, without detailed criteria to structure their initial plans. The UMMC is evaluating the performance of Fannie Mae and Freddie Mac’s EHF plans and encouraging FHFA to adopt an EHF rule analogous to Duty to Serve.

Evaluating the Enterprises’ Role and Commitment to Racial Equity

Last summer the Federal Housing Finance Agency announced that it would require the government-sponsored enterprises Fannie Mae and Freddie Mac to develop three-year plans for advancing equity in housing finance. This webinar explores the effects of housing discrimination in the past and present, what the new plans could mean for equity in housing finance, and how the government can promote equity in housing more broadly. Speakers include Marietta Rodriguez, president and CEO of NeighborWorks America; Chrystal Kornegay, executive director of MassHousing; and George W. McCarthy, president and CEO of the Lincoln Institute of Land Policy.

UMMC Impact

The UMMC focuses on three areas of action: tracking the Enterprises’ DTS and EHF efforts, advocating for meaningful plans and policies, and working constructively with the Enterprises and FHFA to service underserved markets.

Tracking Enterprise Efforts

The UMMC has developed a tracking tool to closely monitor the performance of Fannie Mae and Freddie Mac under Duty to Serve. The tool measures the baseline performance for each objective, the proposed goals for 2022–2024, and the extent of the Enterprises progress toward their goals. It also incorporates UMMC members’ recommendations for further improvement. A tracking tool for Equitable Housing Finance is in development.

Advocating for Meaningful Plans

UMMC members collaborate to address the weaknesses of the Enterprises’ progress and advocate for meaningful improvements. The UMMC advocates by contributing to public listening sessions, writing comment letters, engaging with the media, and hosting webinars to express its recommendations.

In September 2022, the UMMC published a scorecard to assess the Enterprises’ Duty to Serve plans for 2022 to 2024, which were released in April 2022. The scorecard recognizes the plans’ significant improvements, compared with earlier versions, as well as their shortcomings.

Working with the Enterprises and FHFA

The UMMC works constructively with the Enterprises and FHFA. The coalition’s members meet regularly with officials to discuss its recommendations. These conversations help the UMMC understand the barriers that the Enterprises face in implementing DTS and EHF.

Government-Sponsored Enterprises’ (GSEs) Performance

Homeownership has long been part of the American dream, providing families a way to build long-term sustainable wealth. But a history of redlining and racial barriers to accessing capital has meant that this dream is still unattainable for many Americans. Today, the racial wealth gap between Black Americans and white Americans is the largest since the 1960s, and Black homeownership rates lag behind white homeownership rates by nearly 30%. UMMC coordinates 32 major affordable housing organizations for more equitable access to home financing. We collaborate to ensure that Fannie Mae and Freddie Mac meet their mission objectives of bringing housing finance opportunities to American families not traditionally served by the private market.

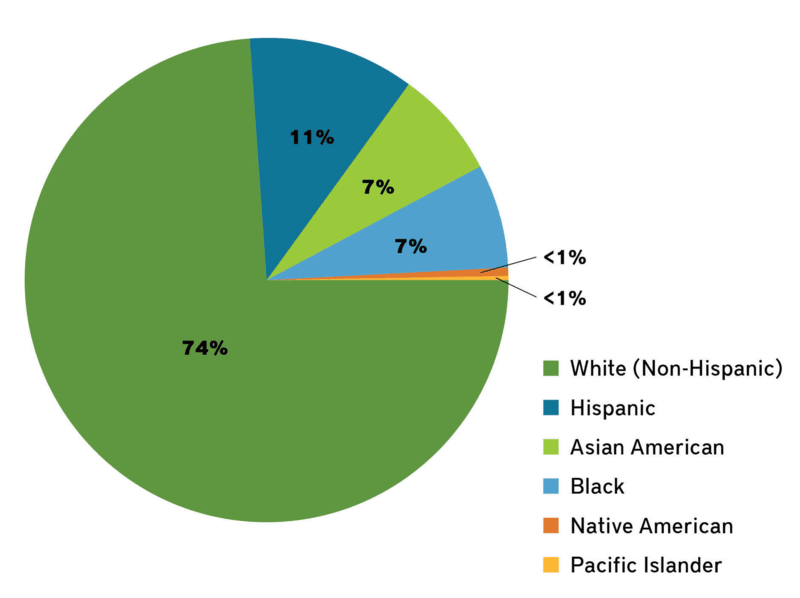

Freddie Mac and Fannie Mae Loan Purchases by Race/Ethnicity 2017-2022

Race

- 6.81% of loans purchased by GSEs between 2017-2022 were for Black households

- Pie chart excludes loans with unreported race data, about 22% of GSE loans

Our Members

The UMMC Includes the following organizations:

Center for Community Progress, cdcb, Enterprise Community Partners, Fahe, Grounded Solutions Network, Homeownership Alliance, Housing Assistance Council, Housing Partnership Network, Institute for Market Transformation, Leading Age, Lincoln Institute of Land Policy, Local Initiatives Support Corporation, National Consumer Law Center, National Council of State Housing Agencies, National Community Stabilization Trust, National Housing Conference, National Housing Trust, Neighborhood Housing Services of Chicago, NeighborWorks America, New Hampshire Community Loan Fund, Next Step, Novogradac, Oklahoma Native Assets Coalition, Opportunity Finance Network, Prosperity Now, RMI, ROC USA, Stewards of Affordable Housing for the Future, The American Council for an Energy-Efficient Economy (ACEEE), Unidos US, and Urban Strategies.

If you are an interested national organization committed to furthering affordable housing finance opportunities, contact Daniel Janzow to learn more about becoming a UMMC Member.